If you’re looking for a predictable, low-risk way to earn extra money this year, bank account bonuses are one of the most overlooked financial strategies available. Banks pay customers hundreds of dollars to open new checking or savings accounts, deposit funds, or set up direct deposits. When structured correctly, this becomes a steady system that produces monthly cash inflows — a legitimate side hustle that leans heavily toward passive income once established.

Read on for a step by step deep dive into the timelines, calendar plans and bank by bank strategies beginning NOW to help you earn $10,000 or more in the next year as a passive income side hustle. This is an easy passive income strategy that works year after year. Many people simply don’t take advantage of these offers because of the deposit requirements, thinking that it’s a lump sum. NO, it’s over time! So a $4,000 deposit requirement over 90 days comes out to $333.33 per week. Read the offer details and you’ll be amazed at how much money you can actually make just by updating your payroll direct deposits each month!

How Bank Bonuses Work

Bank bonuses generally follow the same structure:

- Open a new checking or savings account online.

- Deposit a qualifying amount or set up direct deposits.

- Maintain the account for 60–120 days.

- Receive the bonus automatically once criteria are satisfied.

- Close the account (optional) and move funds to next bonus.

Your primary tasks are:

- Comply with each bank’s requirements

- Manage timelines

- Avoid monthly fees

- Track account open/close dates

- Redirect direct deposit as needed

- Recycle your savings from bank to bank

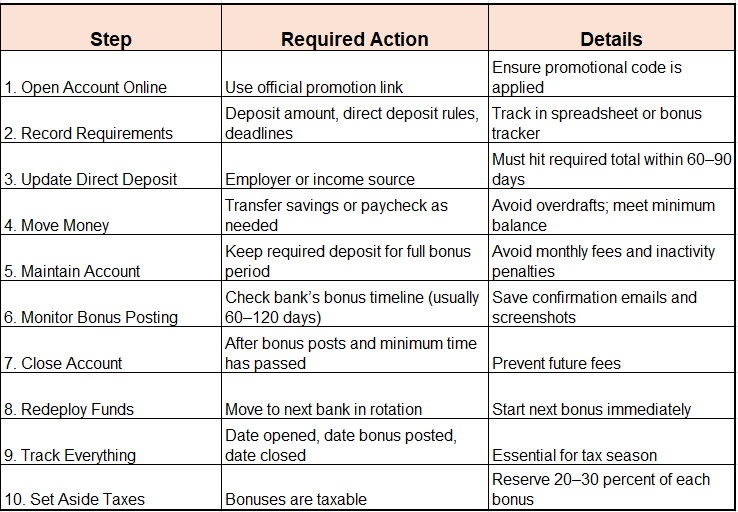

Step-by-Step Instructions for Each Bank Bonus

Below are exact processes including:

- When to open

- What requirements to meet

- What to do next

- When to close

- When to move money

Links to official offer pages (as of November 2025) are included for reference. You will need to research other bank offers later in the year to receive the most updated and profitable bank bonus offers. But these offers provide a framework on what you’re looking for, how to time the account opening, etc.

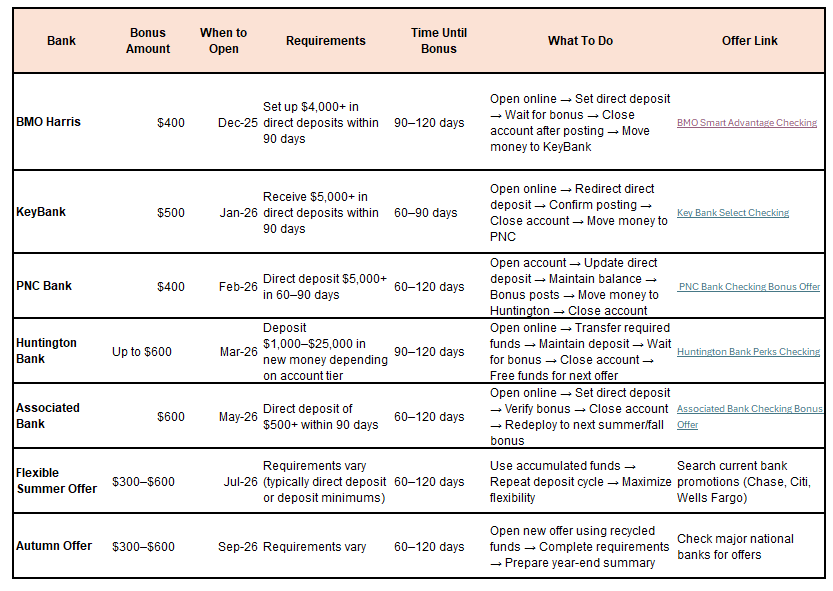

1. BMO Harris (Approx. $400 Bonus)

Offer link: BMO Smart Advantage Checking

Steps

- Open Account Online in December 2025 using the current promotion link.

- Set up direct deposit totaling at least $4,000 within 90 days.

- Keep the account open until bonus posts (usually 90–120 days).

- Verify bonus posted.

- Close Account once bonus has posted and there is no risk of clawback.

- Move Money to next bank (January or February plan).

- Update Direct Deposit to the next bank.

2. KeyBank (Approx. $500 Bonus)

Offer link: Key Bank Select Checking

Steps

- Open Account Online early January 2026.

- Set up direct deposits totaling $5,000 within 90 days.

- Maintain the account until you receive the $500.

- Once the bonus posts, withdraw all funds.

- Close Account (KeyBank allows closure after bonus delivery).

- Move the same payroll/direct deposit to the next bonus opportunity.

3. PNC Bank (Approx. $400 Bonus)

Offer link: PNC Bank Checking Bonus Offer

Steps

- Open Account Online in February 2026.

- Direct deposit requirement: $5,000+ within 60–90 days.

- Keep the account open through the posting period (usually 60–120 days).

- Confirm bonus.

- Close Account or downgrade to avoid fees.

- Move your funds + direct deposit assignment again.

4. Huntington Bank (Up to $600 Bonus)

Offer link: Huntington Bank Perks Checking

Steps

- Open Account Online in March 2026.

- Deposit required new money (amount varies: $1,000 to $25,000).

- Keep the deposit in the account for the full promotional period.

- Monitor for bonus posting.

- Once posted, withdraw money.

- Close Account if no longer needed.

5. Associated Bank (Approx. $600 Bonus)

Offer link: Associated Bank Checking Bonus Offer

Steps

- Open Account Online in May 2026.

- Set up $500+ direct deposits within 90 days.

- Keep the account open until bonus arrives.

- Transfer money once posted.

- Close the account if desired.

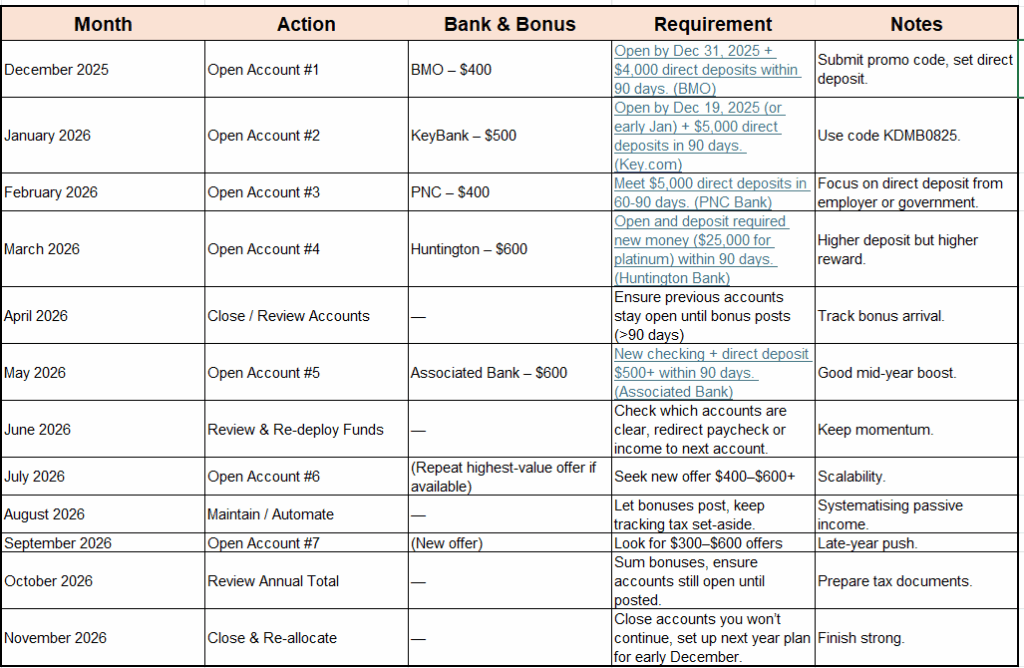

12-Month Bonus Calendar (Start: December 2025)

Below is a month-by-month schedule. Use it as a roadmap or in Excel to track open dates, deposit requirements, bonus post dates, and when to close or move funds.

Table 3: Required Actions for Every Bonus (Checklist)

How to Manage Money Between Banks

Each cycle looks like this:

- Open account

- Deposit funds or set direct deposit

- Wait for bonus

- Close account

- Move full balance to next bank

- Switch direct deposit

- Repeat

The key to hitting $10,000 per year is optimizing the rotation so your funds are always actively qualifying for a bonus, not sitting idle.

Bank Bonus Offer Table: Requirements, Timelines, and Actions

Table 1: Bank Offers, Requirements, and Steps

Final Thoughts

Earning $10,000 using bank account bonuses is absolutely doable — but only if you treat it like a structured side hustle: plan, track, execute. It’s not passive in the sense of “set it and forget it,” but compared to active business models it’s much lighter lift. Given your preference for systematic, data-driven strategies, this aligns well: you’ll build a spreadsheet, track timelines, and produce ready-to-deploy results.